StockMarketEye is one of the most popular choices among stockholders and project managers. All because of its capacity to perform quality documentation management, and simultaneouslytracking investment and resource allocation. It’s a great standalone service which you install once, and rely on it to store information, schedule time, and empower communication for as long as necessary.

Our team of B2B software experts was really impressed with StockMarketEye and its capabilities. In our test of the software we put it through several typical problem scenarios and in all cases it performed really well. In addition to an affordable pricing plan (you only purchase the license once) you can also try out the software first with a great free trial offer. That way you can see the software in action and decide if it’s a solution that will actually benefit your portfolio. You can easily sign up for StockMarketEye free trial here.

The offbeat attractiveness of this financial eye candy among its numerous competitors is simplicity and straightforwardness, which makes it suitable even for startups and freelancing individuals, who will either import investment portfolios from integrated brokerages, or create virtual ones instead to track prospective investors. Standard investment files are also supported (CSV, QIF, and OFX/QFX), which streamlines the process of managing investment portfolios to a point where even non-techies can import information. StockMarketEye is simply one of those products that display performance data in a complex manner (candlestick charts, OHLC, line and mountain charts and technical indicators), but measure it in a fairly simple one. The best news, however, is that all financial information is stored locally, and backed up automatically.

- With unlimited watchlists, StockMarketEye gives you the tools to track and analyze the securities that interest you. Our on-line backup and synchronization features lets you keep the same.

- StockMarketEye is a desktop based portfolio tracker and stock analyzer. The software can create watch lists of stocks and indices to track over time for changes in prices and match to price targets. See stock charts of recent data and data going back years. Gain technical insights from key movement indicators.

For a more comprehensive list of StockMarketEye features check out our full StockMarketEye review.

This month’s Featured Download, StockMarketEye, is a unique portfolio tracking and charting application in that it comes in both Windows and Mac versions. The program is from TransparenTech, costs $39.95, and allows users to track stocks, mutual funds, exchange-traded funds (ETFs), cash and currency pairs. StockMarketEye can also alert you when there is important activity for any of your monitored stock symbols, you can set custom threshold values that determine when an alert is triggered. Other features include PDF reports, export to CSV, dividend tracking and support for international currencies.

Stockmarketeye Download

Just another portfolio tracker or the perfect solution?

StockMarketEye is a smart stock watcher, right as the name indicates. It is at the same time your personal tool for tracking investment, and the insider on markets which locates downsides and opportunities. Still, we won’t emphasize much what it can track, but instead we’ll focus on the tracking mechanism itself, since it is, to say the least, the most intuitive one we’ve seen so far. All in all, StockMarketEye provides a clean market perspective by summarizing performance data in easily readable portfolios.

Now, let us discuss in more detail a few elements which really distinguish StockMarketEye and give it an edge over its competitors.

A complete portfolio solution

You start off quickly, import data from wherever necessary, and organize that data into comprehensive portfolios. By portfolios, we mean collection of assets that appear instantly on your main screen, divided in folders (assets), active folders (watchlists and stock toolbars), and chart areas with indicators. Basically, all your assets are available at your fingertips, ready to use for statistic purposes.

The number of portfolios you can work with is unlimited. You can enter data from all sources or using the specialized SME tool, and organize it in as many investment portfolios as you need. Those can either be your actual investment accounts, group and family investments, or even virtual portfolios where you summarize relevant market information.

You can either use/analyze the portfolios separately, or group them in interrelated categories to obtain an aggregated view of summarized holdings and totals. The reporting feature (which we are about to discuss later in the article) allows you to analyze groups and to make periodical analysis by simply dragging and dropping files.

Even portfolios can be segmented to fractions and categories, once again it can be done with a drag-and-drop procedure, to calculate holdings and totals of more specified groups. All portfolios and groups can be viewed in charts (both performance and market-value ones), which facilitates making historical analysis.

Great reporting features

It is logical to assume that a tool which summarizes investment data in such a comprehensive way will also allow you to extract that data and to use it for statistic purposes. What makes StockMarketEye reporting so special is that it is super-powerful for a tool that never intended to focus on reporting on the first place. Basically, you’re killing two birds with one stone.

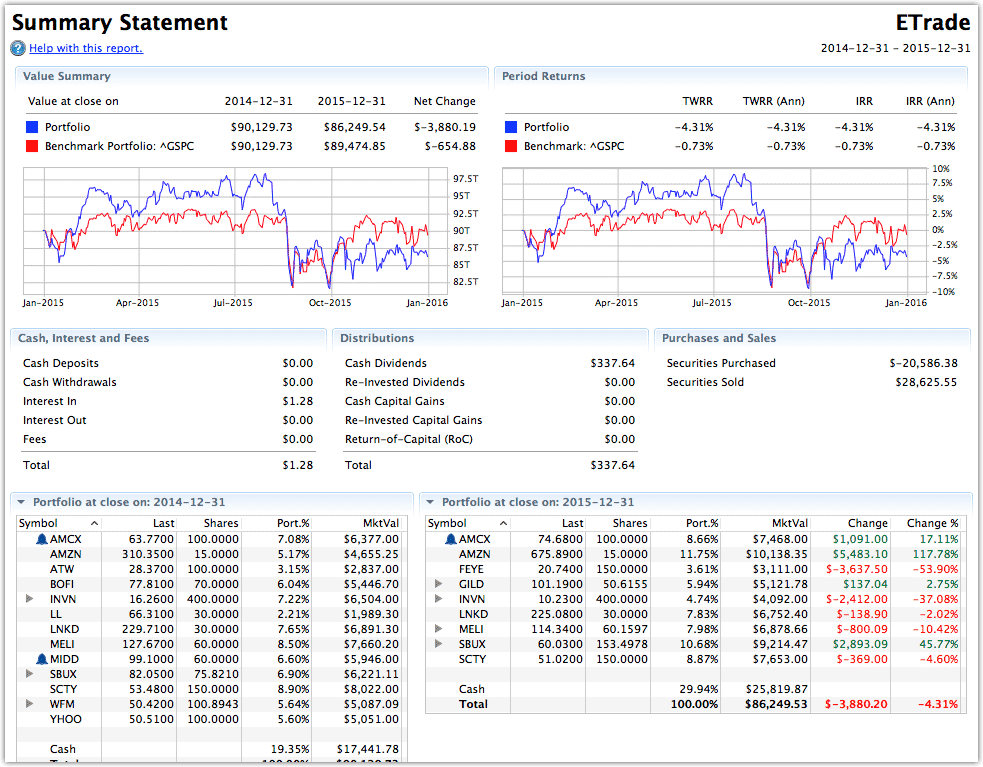

Generally observed, StockMarketEye reports analyze your investment data, all the way from raw transaction lists to unique performance comparators, referring both to your previous and current activities. There is almost no chart that can’t be included: built-in stock charts, historical price charts, OHLC and many others. It is enough to click on the portfolio and to choose the table you want to see displayed, and it will open in an external window packed with useful comparison symbols. In addition, the chartists support 16 different types of technical indicators.

It tracks everything that is happening on the market

With StockMarketEye, you can literally keep an eye on every stock you’re interested in, as there is no threshold to how many of them you can track. Once you’ve picked out the stocks you want to observe, you can organize them in topical watchlists, relying on the fact that currency pairs, exchange traded funds/cash, mutual funds, and all other exchange ticker symbols are supported. Later on, you can group the watchlists and segregate them in categories, the same way you did with your portfolios.

Another important advantage to keep in mind is that StockMarketEye supports almost every world currency, and is available in multiple languages/countries, which makes it perfect for international trade purposes. By multi-currency support, we not only refer to including holdings in a currency different than your base one, but also to automated conversions and gain/loss calculation of exchange differences.

With StockMarketEye, you also gain access to a vast kit of alerts that can be activated for different portfolios and watchlists, and which capture even the most insignificant change of activities. For instance, you can track price modifications, get notified when stocks surpass the intended levels, and even use the powerful Growl integration to receive those notifications on your desktop/mobile screen.

An advanced feature suite

The Investment Tracker is among the easiest ones to set up and to use, as you can import data from multiple supported brokerages, and create unlimited portfolios and watchlists based on it. As we already mentioned, the reporting function provides access to multiple types of charts, comparators and technical indicators, and includes a set of powerful alerts that capture activity disruption. The tool is mobile-friendly (an iOS companion app is available), and it is integrated with most major exchange stocks that operate with different currencies.

A smartly integrated and widely available tool

Due to the fact that the tool was intended to serve the purposes of businesses from all scales and industries, the producers made sure that using it with already installed apps and financial systems won’t be of any concern.

First and foremost, it can be used on iPhones, iPads, Linux, Mac, and Windows, and it is available all over the world (USA, Canada, Latin America, Europe, UK, Asia, and Australia). The official language of StockMarketEye is English.

In terms of watchlists, the tool is pre-populated with: the NASDAQ Composite, the Dow Jones Industrial Average, the Russell 2000 Index, the S&P 500 Index, and many other major indexes from all around the world.

It offers beautiful design

Last, but not least, StockMarketEye has clean and beautiful layouts, something one wouldn’t expect from a finance counter packed with charts and symbols. Moving around is smooth and somehow familiar, as you can navigate through sections easily, and find each particular functionality within seconds. The biggest advantage of working with such user-friendly design is that you get to locate all of you resources immediately, and the structure is so well-organized that it minimizes every risk of confusion or misplacement.

How StockMarketEye Solves Specific Problems

Managing various accounts at various brokerages

Those of you with multiple accounts to bring under one roof will appreciate the power of StockMarketEye to deal with laborious and time consuming holding management from multiple investment locations at once. Once all accounts are in one place, you get an all-embracing insight on holdings and possibilities, the same as your totals that can be analyzed all together. That being said, you will finally have the full picture of where you stand on the net, and how you can allocate resources from one account to the other to make smarter, revenue-boosting investments.

Managing investments within the family

If you’re the one carrying the burden of organizing your family’s investment activity, StockMarketEye can really lend a hand. Managing family investments is not easy among different accounts/brokerages, but becomes significantly less complicated when you can create multiple portfolios, and deal with each of them separately. Needless to repeat, portfolios can be grouped or segregated, analyzed separately and periodically.

Using it as a Swing tracker for tracking multiple tickers

Many users argue that StockMarketEye is most powerful when applied in its Swing tracker capacity, an argument most of us would agree with, knowing the impact of the tool on profitable trade. As we already pointed out, StockMarketEye allows you to follow an unlimited number of exchange stocks, which is pretty much enough for you to be in the right place at the right time. The invaluable access to information keeps and organizes stocks in the shape of watchlists, which you can group and analyze whenever necessary. What is most important is that the tool doesn’t provide only temporary access to stock information, but tracks it permanently, and alerts you on every price movement/stock excess you need to be aware of.

StockMarketEye Pricing

To make things even more perfect, it won’t cost an arm and a leg to put hands around StockMarketEye’s tracking capacity. The merits of it sound much more luxurious than the price would indicate, especially if you consider that you pay a one-time license fee, and there are no recurring costs to cover afterwards.

StockMarketEye pricing is very straightforward. The company offers few license packages, depending on the version you’re trying to purchase, the updates, the technical support, and the intended use. The lowest possible plan costs $59.95, while the most recent one comes with a $99.95 price tag. The company offers generous discounts for students and education staff.

Finally, don’t forget to check their feature-robust 30 days trial, which is absolutely free and doesn’t compromise you to subscribe using credit card data. You can easily sign up for StockMarketEye free trial here.

StockMarketEye Awards and Recognition

Supreme Software Award for 2016

We really found StockMarketEye to be a supreme software and an impressive portfolio tracker. The vendor clearly knows the B2B market well and designed its software in a way that tries (and succeeds at) solving the most common problems and situations. The quality of service offered by StockMarketEye is of the highest sort and because of that StockMarketEye is able to surpass even competitors with firmer market positions and longer histories of operation.

Experts’ Choice Award for 2016

An award given by our panel of independend B2B & SaaS experts. Playstation share play pc. It is a special expert recognition for products that satisfy the most important B2B/SaaS markets’ needs, and assist companies when dealing with current challenges, and developing efficient business solutions.

Stockmarketeye Not Updating

Great User Experience

This award is granted to products and services with outstanding performance, noticeably intuitive interface, and innovative design. We were really impressed with how well designed StockMarketEye is. It offers simple, easy to manage interface and is really simple to start using the software without any intensive training. It also provides a wide range of integrations and supports all popular platforms allowing you to fully use the potiential of their solution.

StockMarketEye SmartScore and Customer Satisfaction

Our B2B experts prepared a thorough StockMarketEye review testing its functionalities, user experience, customer support and other key elements of the service. Final results as summarized by the SmartScore are 8.5/10. The results provided by our Customer Satisfaction Algorithm show the overall user satisfaction with this software is 100%.

- Portfolio Tracking

- Ease of Use

- Research and Analysis Tools

- Value

Summary

Long-term investors this one is for you! StockMarketEye is a portfolio management software that inclines itself towards long-term investors. With a variety of features, StockMarketEye has peaked some interest. Should you be interested in StockMarketEye? Read our review to decide for yourself.

Review Contents[show]

- StockMarketEye Features

- What Type of Trader is StockMarketEye Best for?

Introduction To StockMarketEye

StockMarketEye is a portfolio management software geared more towards long-term investors than active traders. While the interface of StockMarketEye is somewhat outdated, the software is nonetheless intuitive to use and makes it simple to track the performance of multiple portfolios through time. The software offers some basic charting features, but is relatively limited in scope and is matched by the portfolio accounting tools offered by most brokerages.

StockMarketEye Pricing Options

StockMarketEye is a desktop software available for a one-time $49.95 fee for the v4 release, or $99.95 for the soon-to-be-released v5. Users can also purchase v4 and upgrade to v5 when it becomes available for a total of $99.95. Users get free minor updates, but must pay for major updates that are released every 2-3 years.

StockMarketEye also offers a 30-day free trial.

StockMarketEye Features

Portfolio Tracking

The primary function of StockMarketEye is to track the performance of multiple long-term investment portfolios. It is straightforward to create a new portfolio in the software, and to manually enter stock purchases or to import data from a brokerage. StockMarketEye is capable of handling stocks, ETFs, mutual funds, options, and forex trades, and can account for commissions, dividends, and all other relevant collateral transactions.

Once a portfolio has been created, users can see the current market performance of every asset in their portfolio. Data can be updated in real time or on-demand according to user preferences. A nice advantage is that StockMarketEye also imports fundamental data for each stock, which can be quickly compared across stocks in a portfolio.

All of this data is then turned into reports that show the performance of a single portfolio over time (similar to MarketRiders), or all of a user’s portfolios, compared to major indices. While these reports are convenient, it is difficult to see advantages to them over the reporting formats offered for free with most brokerage accounts. Instead, StockMarketEye is primarily useful for tracking multiple portfolios held across brokerages in a single place or for tracking portfolios for which the assets are held across multiple brokerages.

Alerts

One of the useful features of StockMarketEye for investors who take a more active role in managing their portfolios is alerts. Alerts are relatively simple, especially when compared to platforms designed for active traders such as ThinkorSwim. Alerts can only be based on a single criterion, and most available criteria are related to price or gain/loss rather than to any technical indicators.

Charting

StockMarketEye does include some basic charting, although like the rest of the platform these charts are designed to complement fundamentals rather than highlight technical indicators. You won’t find the same charting tools you will find in robust platforms like TradingView and TC2000.

AirBridgeCargo Airlines - Track & Trace. PRODUCTS & SERVICES. Abc XL abc pharma abc DG/Li abc care abc fresh. Abc e-com abc premium abc general abc charter. Abc extraSAFE abc DG abc valuable. COVID-19 Trucking. AirBridge Broadband is dedicated to bringing blazing fast internet to the residents of Idaho, Lewis, and Clearwater Counties. Our plans start at an incredibe 10 Mbps. Just because you live in the country does not mean you cannot enjoy 'big city' internet speeds! With the speeds that our plans provide, you will be able to stream Netflix in. AirBridgeCargo Airlines guarantees safe delivery of reindeer for Wuppertal Zoo in Germany. AirBridgeCargo, one of the leading all-cargo carriers in the transportation of live animals, has successfully delivered four reindeer from Moscow (Russia) to Frankfurt (Germany). We will transfer your files easily, safely and rapidly from one place to another. You can send them directly to an email address or share files using a unique link. Airbridge.

KeyShade only does one thing: manage your passwords. Once you know to look for KeyShade’s icon in the top-right of your screen, it’s a constant companion. Free to use, inexpensive to sync. NETSHADE PROTECTS YOUR PRIVACY ONLINE WHY USE A VPN? A VPN is one of the most crucial parts of a secure and private Internet connection. It ensures that the data you send and receive is encrypted, and that all your network traffic flows through an intermediary proxy server. Keyshade.

The shortest chart period available is one day and the selection of technical analyses that can be applied to charts is limited to the most popular indicators. One nice feature of the StockMarketEye charts is that they make it extremely simple to compare two stocks, ETFs, mutual funds, or indices over time. However, it is again difficult to identify any unique features of these charts that differentiate them from what can be obtained from a brokerage or a free charting software.

Mobile Apps

A modern advantage to StockMarketEye is that the software is available as a mobile app for both Android and iOS devices. The app layout is relatively streamlined and makes it easy to see the performance of assets in a portfolio at a glance, but lacks the advanced portfolio organization tools of the desktop software. Note that the app costs $1.99 on the Apple App Store and $2.00 on the Google Play Store.

Layout and Customization

The real reason to use StockMarketEye is that it allows users to finely tune their organization of their portfolios. Investors can create new portfolios with the click of a menu button, as well as organize portfolios into groups for different purposes. Within the navigation pane on the left of the platform, portfolios can also be dragged-and-dropped to re-order them and move them into different groups.

The interface of the StockMarketEye software is somewhat reminiscent of an old version of Microsoft Excel (similar to Market XLS)(similar to Market XLS). For example, all asset data is tabulated in a grid that resembles Excel. However, while this interface appears outdated, it is extremely simple to navigate and does not contain unnecessary menus. It also makes exporting data simple, since what you see in StockMarketEye is almost exactly what you’ll get if you choose to export a CSV file.

One thing to watch out for is that StockMarketEye offers both portfolios and watchlists. Although the two asset lists are fundamentally the same and almost entirely identical in terms of the options available for managing them within the software, StockMarketEye strictly delineates them. Therefore, there are near-identical menus for portfolios and watchlists.

Compatible Brokerages

It is straightforward to link StockMarketEye to accounts at most major US brokerages. However, keep in mind that this account link can only be used to import transaction data when creating a portfolio, and cannot be used to update transactions or to buy and sell holdings.

StockMarketEye Platform Differentiators

StockMarketEye is a relatively simplistic portfolio tracking software that does not offer much in the way of unique features. The main advantage to StockMarketEye is that it can import data from a number of different brokerages as well as easily handle manual transactions. This makes it possible to track the performance of portfolios that have been purchased across multiple brokerages or that involve multiple types of assets. The ease with which users can export data to Excel – given the Excel-like interface of the software – also makes it simple to extend the usability of portfolio performance data.

What Type of Trader is StockMarketEye Best for?

StockMarketEye is best for long-term investors who have multiple portfolios with different goals or who have holdings across multiple different brokerages. The platform does feature basic charts, fundamental data, and price-based alerts for investors who want to take a more active role in managing their holdings. However, it does not offer the advanced research tools that more heavily involved traders would want, nor the analyst research and recommendations that many brokerages provide.

Pros

- Easily import transaction data from brokerages

- Organize portfolios and watchlists into groups with drag-and-drop functionality

- Basic charts, fundamental information, and price-based alerts

- Excel-style interface makes exporting data simple

- Mobile apps available for iOS and Android

Cons

- Few unique features beyond what most brokerages provide

- Cannot be used to buy and sell holdings from brokerage accounts